Tax bracket planning can reduce your IRS bill. Learn how to time income, use deductions, and invest smarter to stay in a lower bracket and save more.

Tax strategies

Powerful Next Steps to Take After Filing Your Taxes

What to do after filing your taxes? Organize documents, plan estimated taxes, adjust withholdings & optimize your tax strategy for next year. Stay tax-ready!

From April and Beyond: Powerful Year-Round Tax Planning Tips

Discover why tax planning isn’t just for tax season. Learn how a year-round strategy can help you reduce liabilities, maximize deductions, and stay financially prepared.

Tax Refund Strategies: Smart Ways to Make the Most of Your Refund

Looking for smart tax refund strategies? Discover the best ways to use your tax refund—pay off debt, boost savings, invest, or grow your financial future.

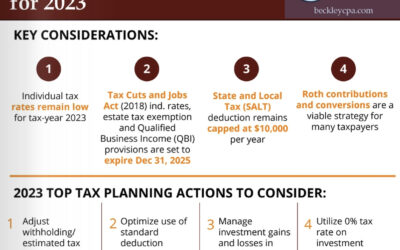

Top 10 Tax Planning Action Items for 2023

Explore 10 essential tax planning action items to help you reduce liabilities, stay compliant, and make smarter financial decisions throughout the year.

Epic Tax Return Fails: Avoid These Common Tax Mistakes and Save Money This Year

Avoid common tax mistakes that lead to penalties and lost savings. Learn how to report income accurately, pay on time, and maximize deductions.

Streamline Your Tax Preparation with Beckley & Associates Client Dashboard

Introducing the Beckley & Associates Client Dashboard, a powerful tool designed to simplify and expedite the tax prep process.

Simplify Tax Filing and Payments with an IRS Online Account

Creating an IRS online account can simplify your tax season and provide you with access to important information.

Tax Reform, How Will it Affect You?

Explore the transformative impact of the Tax Reform of 2017 as discussed by CPA Jeff Beckley.

Use This Secure Service To Pay Your Taxes Online!

Use this secure service to pay taxes for Form 1040, estimated taxes, or other forms directly from your checking or savings account at no cost to you.

Recent Posts

- Beyond Appreciation: How To Use Real Estate for Wealth and Tax Strategy

- AI in Accounting Firms: Unlocking Efficiency and a Better Client Experience

- The Power of Strategic Philanthropy: Tax-Smart Giving for High-Net-Worth Individuals

- From Spreadsheets to Smart Systems: How AI Bookkeeping Is Transforming Accounting

- Employer Tax Credits Every Small Business Should Revisit Before Year-End

Categories

- AI & Automation (4)

- Bookkeeping & Accounting Software (6)

- Financial Planning & Wealth Building (6)

- Firm News & Updates (4)

- General Tax Strategies (10)

- High-Net-Worth & Wealth Planning (10)

- IRS & Tax Policy Updates (4)

- Retirement Planning (10)

- Small Business & Entrepreneurs (17)

- Tax Compliance (8)

- Tax Deductions & Credits (13)