Understanding your partner’s financial love language can reduce money stress and strengthen your relationship. Learn how to align financial goals together.

A collection of videos and articles to support your journey toward financial excellence.

Understanding your partner’s financial love language can reduce money stress and strengthen your relationship. Learn how to align financial goals together.

Strategic Roth IRA conversion can protect your savings, reduce future taxes, and boost retirement income. Learn why now may be the perfect time to act.

Most people file a tax return because they have to, but even if you don't, you might be eligible for a tax refund and not know it. The tax tips below should help determine whether you must file a tax return this year. General Filing Rules Whether you need to file a...

Starting a business? Get essential startup tax tips to avoid penalties, choose the right structure, and track expenses with confidence.

Find out how long to keep business tax records, IRS retention rules, and best practices for recordkeeping to stay compliant and audit-ready.

BOI filing requirements can be confusing — but missing them can cost you. Learn who must file, key deadlines, and how to stay compliant with confidence.

Learn how to navigate Required Minimum Distributions (RMDs) strategically to lower your tax burden, avoid penalties, and maximize retirement savings.

Growing your business? Avoid tax surprises with smart planning. Learn how to reduce liabilities, protect cash flow, and grow with confidence.

Looking for smart tax refund strategies? Discover the best ways to use your tax refund—pay off debt, boost savings, invest, or grow your financial future.

Protect what matters most with simple estate planning strategies. Secure your legacy, avoid stress, and give your family peace of mind.

Welcome, readers! In this post, we're delving into the world of deductible expenses for advertising and promotion, as expertly explained by Jeff Beckley, a representative from Beckley and Associates. Jeff sheds light on the nuances of this crucial topic, helping you...

Strategic business planning helps secure financing, manage risks, and drive growth. Learn key steps to create a business plan for success.

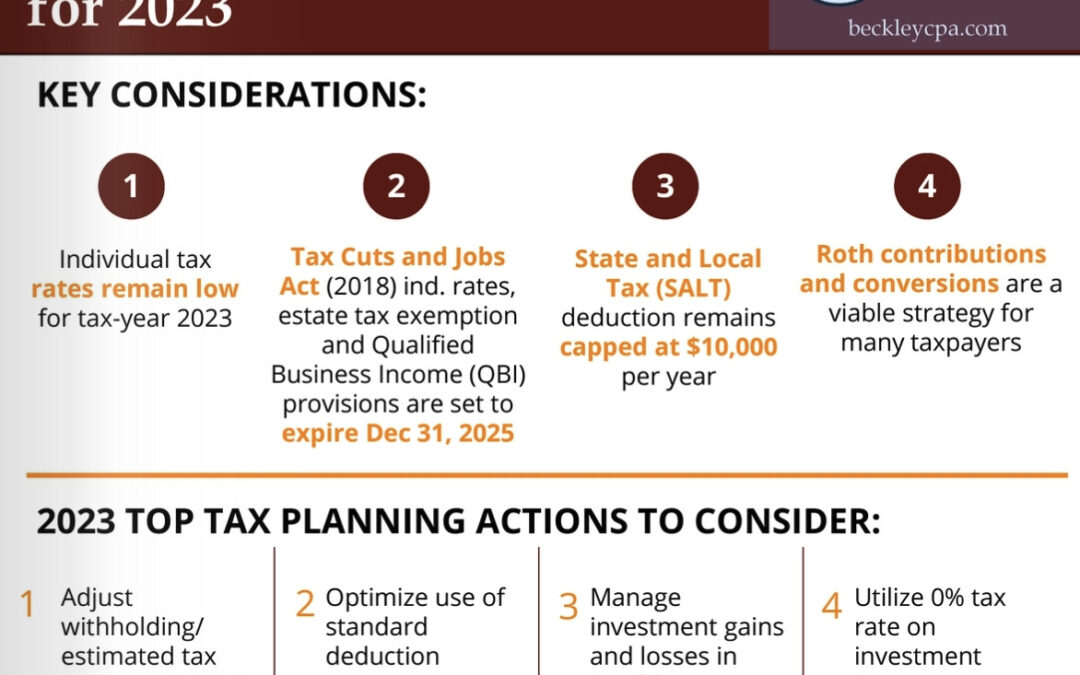

Explore 10 essential tax planning action items to help you reduce liabilities, stay compliant, and make smarter financial decisions throughout the year.

Prepare for entrepreneurial success with our 10 essential steps for starting your new business.

S Corporation vs LLC—which is best for your business? Learn the key differences, tax benefits, and factors to help you make the right choice.

Avoid common tax mistakes that lead to penalties and lost savings. Learn how to report income accurately, pay on time, and maximize deductions.

Find out how long to keep business tax records, IRS retention rules, and best practices for recordkeeping to stay compliant and audit-ready.

BOI filing requirements can be confusing — but missing them can cost you. Learn who must file, key deadlines, and how to stay compliant with confidence.

Celebrating 20 years, Beckley & Associates is a Plano CPA firm for strategic tax, advisory, and accounting services that give businesses peace of mind.

Discover the Beckley & Associates difference in our latest blog post. Learn how our family values, trust, and proven approach can redefine success for your business.