Join us as we explore the nuances of maintaining clear records for bank accounts, credit cards, and cash transactions.

A collection of videos and articles to support your journey toward financial excellence.

Join us as we explore the nuances of maintaining clear records for bank accounts, credit cards, and cash transactions.

Learn how to master Profit and Loss Statements (P&L Statements) in our latest blog post. Discover their key elements, importance for your business, and how they can influence decision-making and financial stability.

Welcome, readers! In this post, we're delving into the world of deductible expenses for advertising and promotion, as expertly explained by Jeff Beckley, a representative from Beckley and Associates. Jeff sheds light on the nuances of this crucial topic, helping you...

Strategic business planning helps secure financing, manage risks, and drive growth. Learn key steps to create a business plan for success.

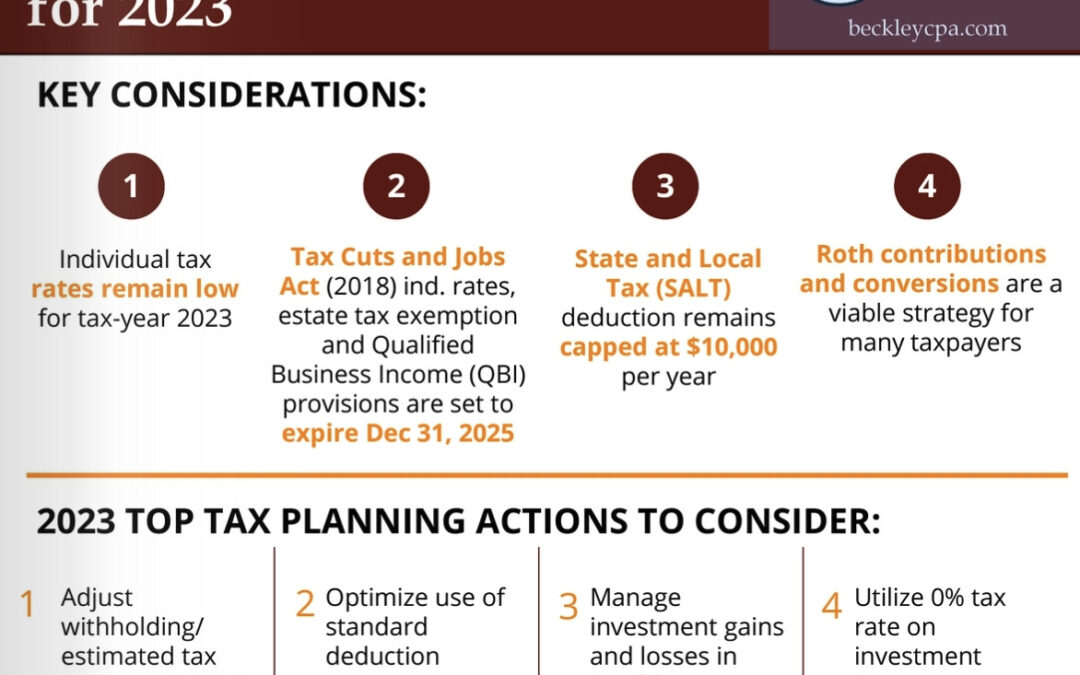

Explore 10 essential tax planning action items to help you reduce liabilities, stay compliant, and make smarter financial decisions throughout the year.

Prepare for entrepreneurial success with our 10 essential steps for starting your new business.

Learn how to navigate Required Minimum Distributions (RMDs) strategically to lower your tax burden, avoid penalties, and maximize retirement savings.

Growing your business? Avoid tax surprises with smart planning. Learn how to reduce liabilities, protect cash flow, and grow with confidence.

Looking for smart tax refund strategies? Discover the best ways to use your tax refund—pay off debt, boost savings, invest, or grow your financial future.

Protect what matters most with simple estate planning strategies. Secure your legacy, avoid stress, and give your family peace of mind.

Required minimum distributions (RMDs) and how they play a crucial role in maximizing your retirement savings.

We will explore what Required Beginning Dates (RBDs) are, why they are crucial, recent changes in RBDs, and how they can impact your retirement strategy.

Creating an IRS online account can simplify your tax season and provide you with access to important information.

The Residential Clean Energy Property Credit is a tax credit that can help homeowners save money on the cost of installing clean energy equipment.

A CPA business advisor can help with financial strategy, business planning, and growth. Learn how a CPA can guide your small business to success.

Unlock Savings: 6 Tax Tips for Retirees and Older Adults to Maximize Benefits and Minimize Liabilities.

Find out how long to keep business tax records, IRS retention rules, and best practices for recordkeeping to stay compliant and audit-ready.

BOI filing requirements can be confusing — but missing them can cost you. Learn who must file, key deadlines, and how to stay compliant with confidence.

Celebrating 20 years, Beckley & Associates is a Plano CPA firm for strategic tax, advisory, and accounting services that give businesses peace of mind.

Discover the Beckley & Associates difference in our latest blog post. Learn how our family values, trust, and proven approach can redefine success for your business.