Discover the Beckley & Associates difference in our latest blog post. Learn how our family values, trust, and proven approach can redefine success for your business.

Content Vault

A collection of videos and articles to support your journey toward financial excellence.

Mastering Business Documentation: Bank Accounts, Credit Cards, and More

Join us as we explore the nuances of maintaining clear records for bank accounts, credit cards, and cash transactions.

Understanding Profit and Loss Statements: Simplified

Learn how to master Profit and Loss Statements (P&L Statements) in our latest blog post. Discover their key elements, importance for your business, and how they can influence decision-making and financial stability.

Deductible Expenses for Advertising and Promotion

Welcome, readers! In this post, we're delving into the world of deductible expenses for advertising and promotion, as expertly explained by Jeff...

Keys To Success: The Importance of a Business Plan

Learn why a well-crafted business plan is crucial for your success.

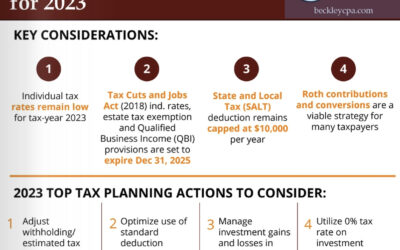

Top 10 Tax Planning Action Items for 2023

Download our Top 10 Tax Planning Action Items for 2023 PDF Download PDF Here Top Tax Planning Actions for 2023: Navigating Your Financial Future Are...

10 Crucial Action Items for Starting Your New Business

Prepare for entrepreneurial success with our 10 essential steps for starting your new business.

S Corporation vs LLC – The Ultimate Tax Strategy Debate for Your Business

In this comprehensive blog post, we delve into the crucial decision of whether to recognize your LLC as an S corporation.

Epic Tax Return Fails: Common Mistakes to Avoid

As the conclusion of the tax season arrives, it’s crucial to reflect on common accounting mistakes that can have significant consequences.

Streamline Your Tax Preparation with Beckley & Associates Client Dashboard

Introducing the Beckley & Associates Client Dashboard, a powerful tool designed to simplify and expedite the tax prep process.

Securing Your Financial Future

The Secure Act 2.0 introduces several key provisions aimed at securing your financial future.

New Rules For RMDs in 2023: Maximize Your Retirement Savings

Required minimum distributions (RMDs) and how they play a crucial role in maximizing your retirement savings.

Unlock Your Retirement Dreams: Discover Your Required Beginning Date

We will explore what RBDs are, why they are crucial, recent changes in RBDs, and how they can impact your retirement strategy.

Simplify Your Tax Season with an IRS Online Account

Creating an IRS online account can simplify your tax season and provide you with access to important information.

Residential Clean Energy Property Credit – Save Money and Help the Environment

The Residential Clean Energy Property Credit is a tax credit that can help homeowners save money on the cost of installing clean energy equipment.

Why You Need a CPA as Your Primary Business Advisor

An important part of growing your business involved getting the right professionals to help you.

Taxable vs. Nontaxable Income

Stay informed about essential tax deadlines and updates from March to December 2023 with our comprehensive guide.

Do You Need To File a 2022 Tax Return?

Uncover the refund opportunities hidden within employment tax.

Tax Breaks for Older Adults and Retirees

Unlock Savings: 6 Tax Tips for Retirees and Older Adults to Maximize Benefits and Minimize Liabilities.

What is a Designated Roth Account

Discover the Benefits: Leveraging Designated Roth Accounts in Your Retirement Plan for Tax Savings and Flexibility.